The Single Strategy To Use For Personal Loans copyright

The Single Strategy To Use For Personal Loans copyright

Blog Article

The Main Principles Of Personal Loans copyright

Table of ContentsGetting My Personal Loans copyright To WorkThe 45-Second Trick For Personal Loans copyrightThe Personal Loans copyright PDFs10 Simple Techniques For Personal Loans copyrightWhat Does Personal Loans copyright Mean?

Allow's dive right into what a personal financing actually is (and what it's not), the reasons individuals utilize them, and just how you can cover those insane emergency costs without handling the problem of financial debt. A personal car loan is a round figure of money you can obtain for. well, virtually anything.That does not include borrowing $1,000 from your Uncle John to assist you spend for Christmas presents or letting your roommate area you for a couple months' rental fee. You shouldn't do either of those points (for a number of reasons), yet that's technically not a personal car loan. Personal loans are made with an actual economic institutionlike a financial institution, credit rating union or online lending institution.

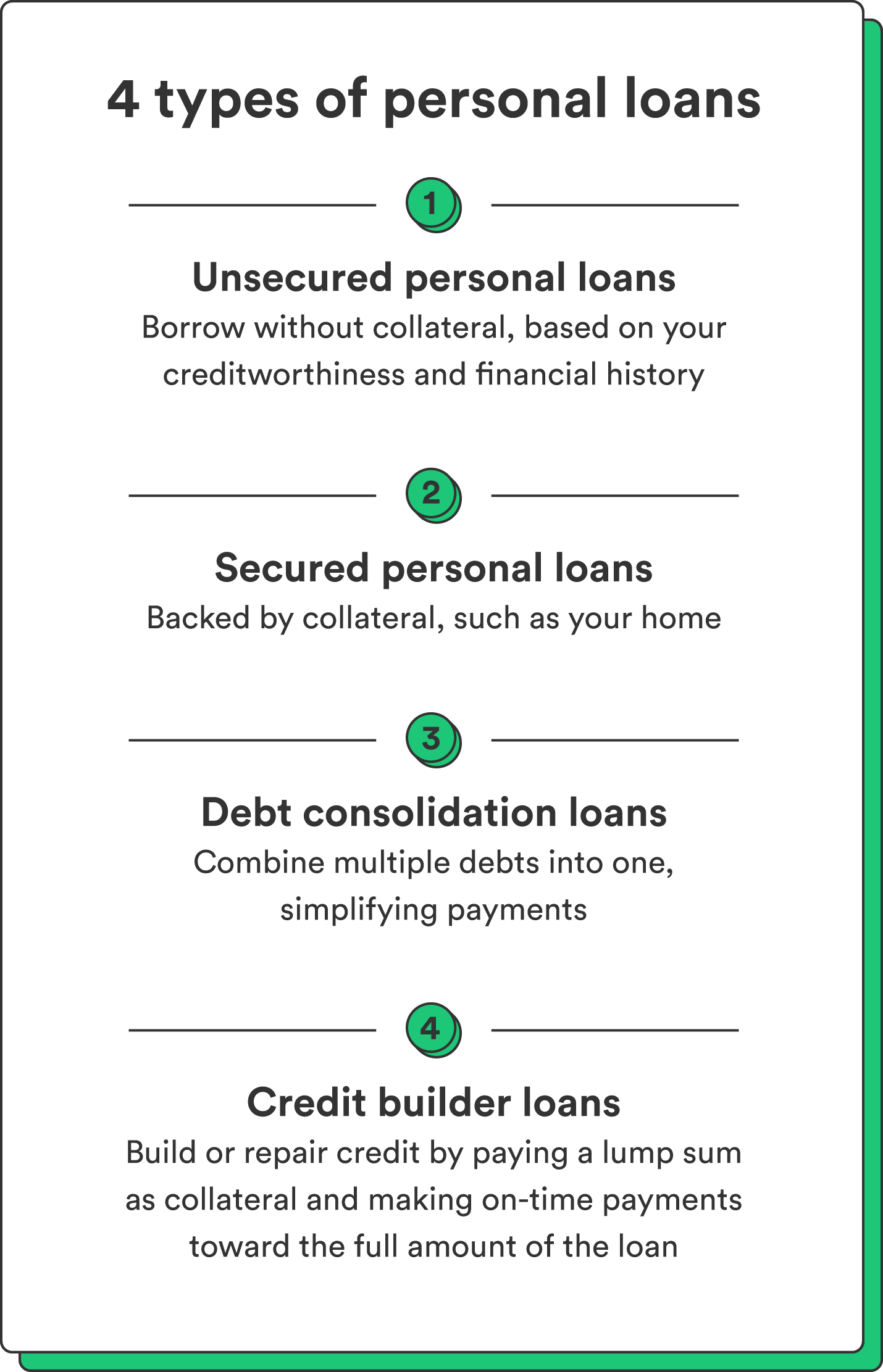

Allow's take an appearance at each so you can recognize specifically just how they workand why you do not require one. Ever before. The majority of individual car loans are unsafe, which implies there's no security (something to back the lending, like a vehicle or residence). Unsafe financings commonly have higher rate of interest and require a much better credit rating since there's no physical item the lending institution can take away if you do not compensate.

Some Known Questions About Personal Loans copyright.

Stunned? That's okay. No issue how great your credit is, you'll still need to pay interest on the majority of individual loans. There's constantly a rate to spend for obtaining cash. Protected personal finances, on the other hand, have some sort of security to "secure" the funding, like a watercraft, jewelry or RVjust to name a couple of.

You might also take out a protected personal funding utilizing your vehicle as collateral. Trust us, there's nothing safe concerning guaranteed financings.

Simply due to the fact that the settlements are foreseeable, it doesn't indicate this is a good offer. Personal Loans copyright. Like we stated previously, you're quite much guaranteed to pay passion on an individual car loan. Just do the math: You'll wind up paying means extra in the future by taking out a car loan than if you 'd simply paid with cash

Not known Facts About Personal Loans copyright

And you're the fish holding on a line. An installation lending is a personal lending you repay in dealt with installments with time (typically when a month) until it's paid in complete - Personal Loans copyright. And do not miss this: You need to pay back the original loan quantity before you can obtain anything else

Don't be misinterpreted: This isn't the exact same as a credit score card. With line of credits, you're paying rate of interest on the loaneven if you pay promptly. This sort of funding is incredibly tricky because it makes you assume you're handling your financial debt, when truly, it's handling you. Cash advance.

This one obtains us riled up. Because these businesses prey on individuals who can not pay their expenses. Technically, these are temporary finances that offer you your paycheck in breakthrough.

About Personal Loans copyright

Why? Because points get actual unpleasant genuine fast when you miss out on a repayment. Those creditors will come after your wonderful granny who guaranteed the financing for you. Oh, and you must never ever guarantee a lending for any person see here now else either! Not only might you get stuck to a loan that was never implied to be your own to begin with, however it'll spoil the connection before you can state "compensate." Trust us, you don't wish to get on either side of this sticky situation.

All you're actually doing is using new financial obligation to pay off old financial debt (and expanding your loan term). Companies recognize that toowhich is specifically why so many of them offer you debt consolidation loans.

And it begins with not borrowing any more money. Whether you're believing of taking out a personal funding to cover that kitchen remodel or your overwhelming credit card costs. Taking out financial debt to pay for things isn't the method to go.

How Personal Loans copyright can Save You Time, Stress, and Money.

And if you're taking into consideration a personal financing to cover an emergency situation, we obtain it. Obtaining cash to pay for an emergency just rises the anxiety and hardship of the scenario.

:max_bytes(150000):strip_icc()/Pay-Day-Loan-Personal-Loan-dfdeaa22f6ea4790b1c966fcd6c937cf.jpg)

Report this page